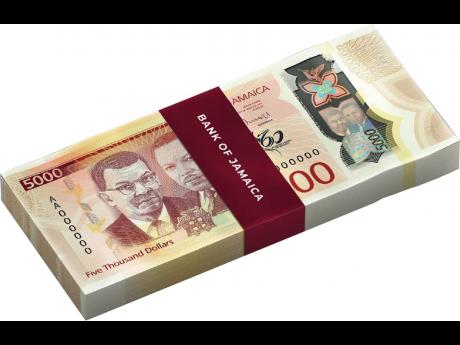

Blind man robbed of nearly $2 million

A 60-year-old blind man from Clarendon is pleading with the authorities to help him recover nearly $2 million that was mysteriously siphoned from his bank account.

The man, who was a victim of gun violence at age 19, lost his sight decades ago and says life has been a relentless struggle ever since.

"Mi blind fi 41 years now. Mi life neva easy, but mi always a push through," he shared with THE STAR. His troubles deepened recently when he discovered that $1.8 million was taken from his savings.

"A mi son first notice say something nuh right. I sent him to draw money from mi account and him see $30,000 missing. Well, truly, mi nuh understand the whole works of the banking system when him a tell me, mi just push it aside. The next son, I told him to draw [some money] and he said, there's something wrong. 'X' amount of money has been drawn from the account and this is something you have to go into the bank with," he said.

The man said that the customer service supervisor told him that checks showed several transactions, including to various websites, fast-food outlets, supermarkets, and even high-end restaurants. The transactions have been traced to an email. He said the bank cancelled the card and issued him a new one, and the police have been notified. But he is yet to receive any reimbursement.

Despite his blindness, the man manages to earn a living by harvesting and selling natural herbs like cerasee and sarsaparilla.

"Mi nuh hide how mi get mi money. Mi own mi property, and mi have a small business wid mi son," he said. But he admitted that the theft has crippled his financial and mental stability.

"It affect me so much that sometimes a just the ganja mi haffi tek fi it. Mi can't focus, mi haffi sell all mi truck. I can't finance it no more," he admitted.

Patrick Linton, chief cybersecurity expert at the Major Organised Crime and Anti-Corruption Agency (MOCA), explained that this incident is a classic example of how vulnerable individuals can be targeted.

"They don't even need to be blind to be vulnerable. Fraudsters don't need to clone a card; they can simply capture card details through photos or online phishing attempts," Linton explained. He advised anyone who suspects that they are victims of fraud should act quickly.

"If you notice unauthorised transactions, block your card immediately and report it to your bank. The police and MOCA can collaborate to trace funds, but it requires detailed reports from the bank, including transaction history and potential CCTV footage."

He also emphasised that people need to be constantly reminded about the dangers of sharing their card details.

"Institutions and communities should prioritise awareness campaigns," he added. The man said he just wants help to get his money back.

"Life hard enough fi a blind man already. Mi nuh deserve dis."